Products

The riskine product portfolio currently includes over 40 modules and is continually being developed and extended. Our solutions are available as API (https://docs.riskine.com/) or with an interface that matches your corporate design. We are known for successful sales solutions — lead generation, advisory & closing and follow-up advisory across all channels —and we support you from goal definition through to the ongoing success measurement of the implemented solutions.

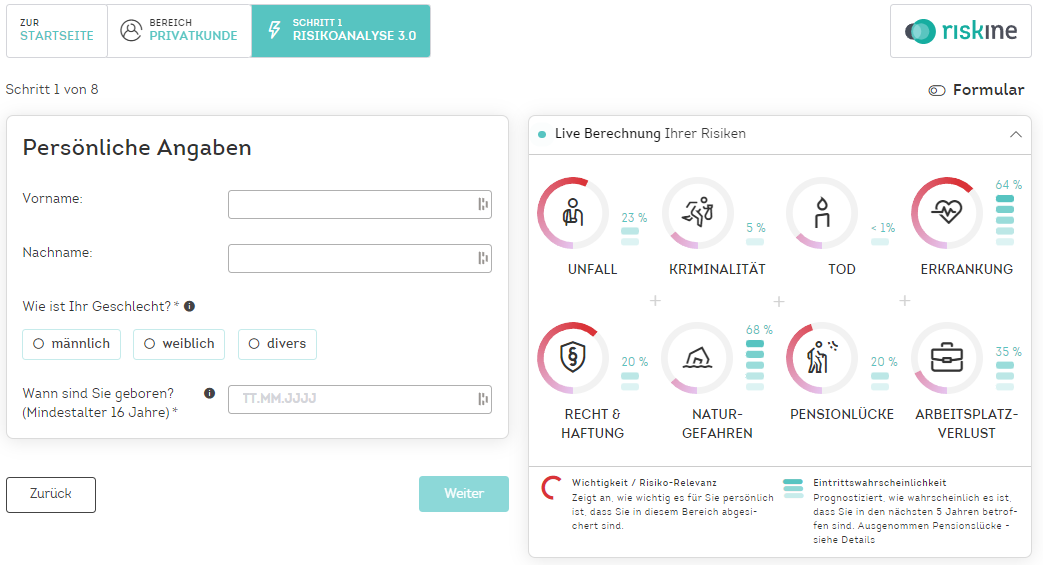

Risk Analysis

Our Risk Analysis evaluates your customer’s risks through intelligent question paths and derives corresponding product recommendations. Existing and external contracts are also considered.

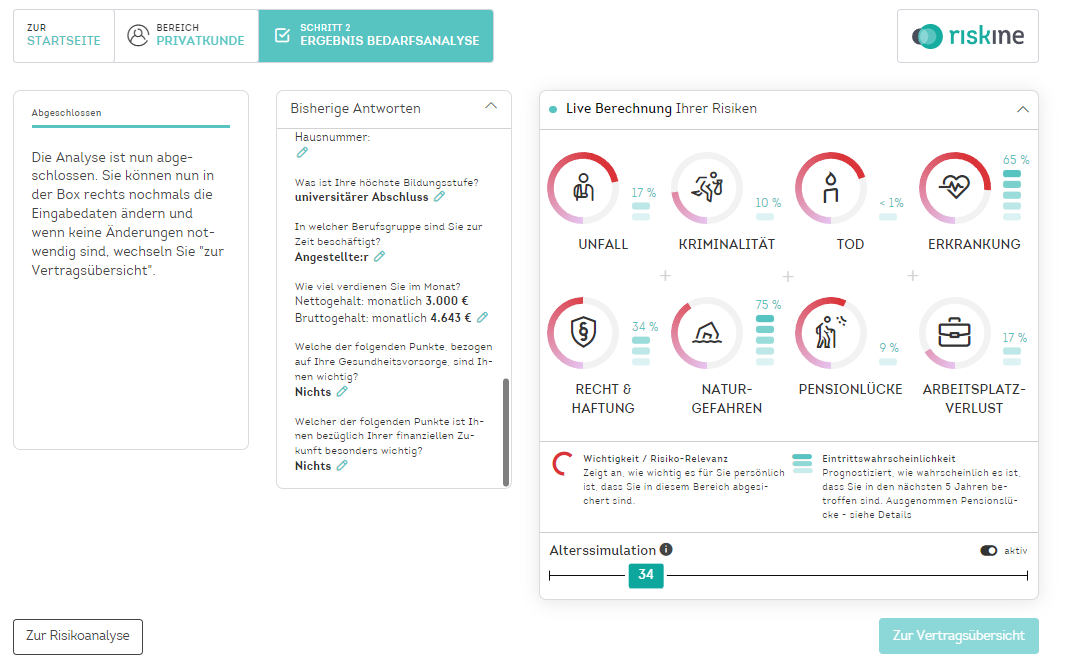

Risk Analysis for Private Customer Advisory

The risk analysis in private customer advisory captures and calculates, through individual sequences of questions and relevant information sources in the background, the objective risks, subjective needs, and risk preferences of your customers. These are reflected in comprehensible, tailored product recommendations (including coverage amounts). This makes risks understandable and transparent for both advisors and customers. Not only does this enhance the quality of the advisory service, but it also leads to sustainable customer relationships as well as more cross-selling opportunities.

Once all questions are answered you can easily simulate how your customers’ risks change as they age, using the age simulation slider. This makes it even clearer that different risks and issues become relevant throughout life and thus regular reviews and adjustments of existing insurance and retirement products may be necessary.

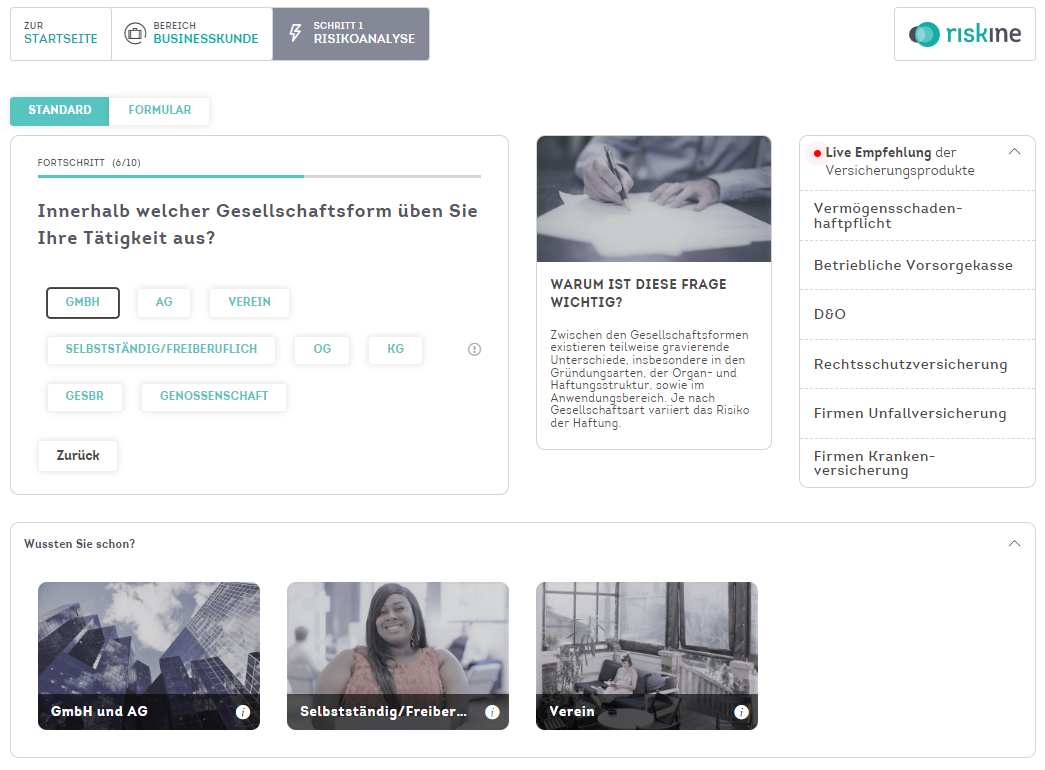

Risk Analysis for Business Customer Advisory

Our Risk Analysis for Business Customer Advisory evaluates a company’s risks and insurance needs through intelligent question paths. Every answer leads to an adjustment of their protection need as well as their product prioritization. Thus, risks are made understandable and transparent. The risk analysis not only increases trust in the advisory process but also provides less experienced advisors with the opportunity to ensure high-quality advice.

Product Advisory

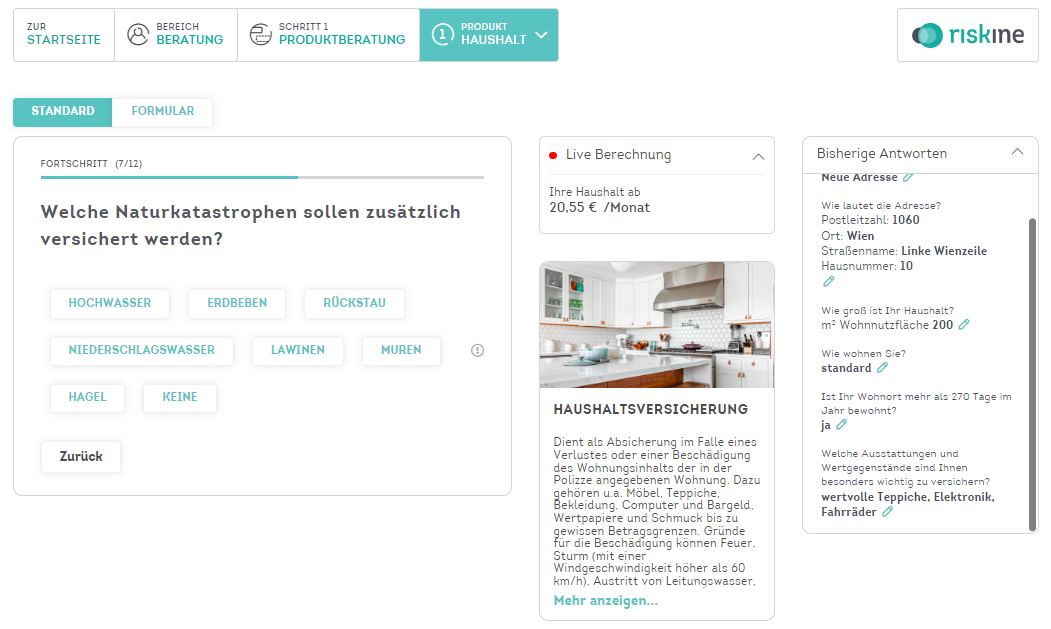

For Private Customer Advisory

Our Product Advisory for private customers offers product and topic-specific question paths for different insurance products to determine premiums/pricing.

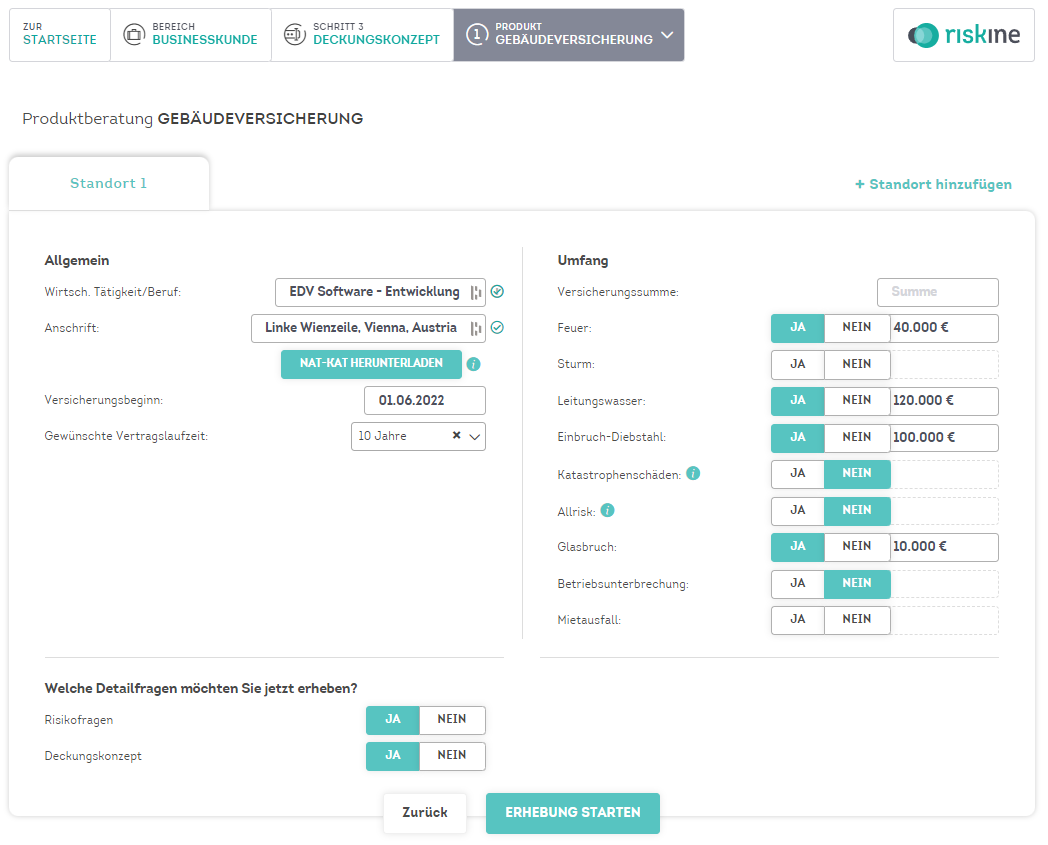

For Business Customer Advisory

Our Product Advisory for business customers offers industry- and product specific question paths for different insurance products to determine premiums/pricing.

The riskine Product Advisory provides product- and topic-specific question paths for determining tariffs and completing insurance contracts. This offers important advantages for both customers and advisors, whether in private or business customer advisory.

• Optimized question progression: Queries generate the shortest path through the individual advisory session. Previously asked questions are skipped and answers that can be anticipated are not asked. Additionally, questions adapt according to previously given answers and their information is taken and used for further calculations. These optimizations are the basis of our graph technology and save advisors and customers valuable time and energy.

• Family advisory : For some products in the private customer sector, it often makes sense to consider not only the wishes and needs of the policyholder themselves, but also those of their family members. For example, supplementary health insurance can be calculated quickly and easily for the whole family in real time, automatically considering special combination offers or discounts.

• Integrated algorithms in real-time: Throughout the entire advisory conversation, gap calculations, coverage amounts, risks, as well as product recommendations and prioritizations are provided in real-time. The comprehensive analyses and evaluations offer an optimal basis for holistic advisory.

• Individual text labels: It is possible to generate different question- and answers texts from the same advisory model respectively the same database. This facilitates easy execution in multiple languages, addressing customers in a formal/informal way (e.g. based on age) or front-end specific texts. For instance, you can use long texts for personal advisory and shorter texts with the same content for self-service advisory.

Product Recommender

The Product Recommender is an intelligent machine learning plugin that can be integrated into digital advisory journeys. It analyzes user behavior and decisions, can provide recommendations for a specific product, or target campaigns to the right target group. Based on the purchasing decisions of customers with similar profiles, product recommendations can be generated for your customers (algorithm: next best product).

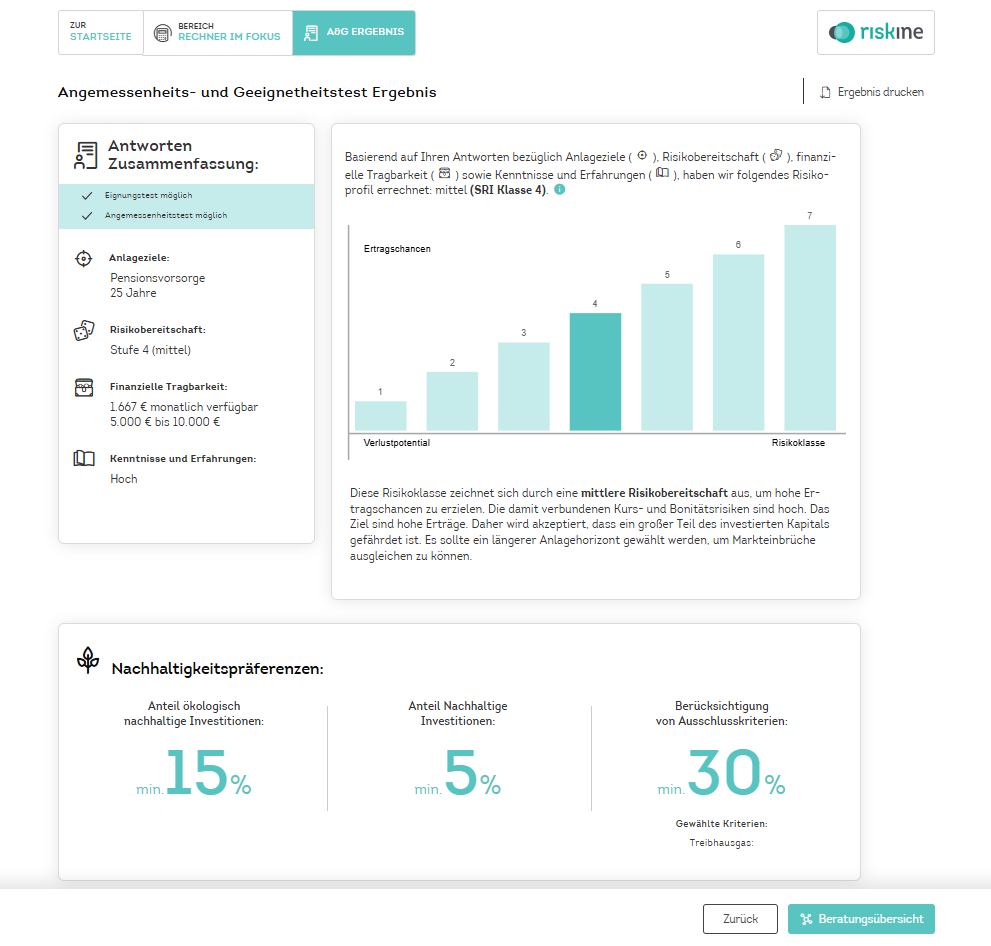

Adequacy & Suitability Test

The Adequacy & Suitability Test, which is the most important instrument for investment advisory, holistically captures your customer’s financial goals, willingness to take risks, financial sustainability, knowledge & experiences regarding investments as well as their ESG preferences. It also assists in determining risk-bearing capacity and risk affinity.

Throughout the entire advisory process, content is presented in an understandable and informative manner, with additional knowledge on this complex subject.

Your customers’ risk preferences and tendencies are also clearly visualized. This ensures a transparent advisory process that meets all regulatory requirements.

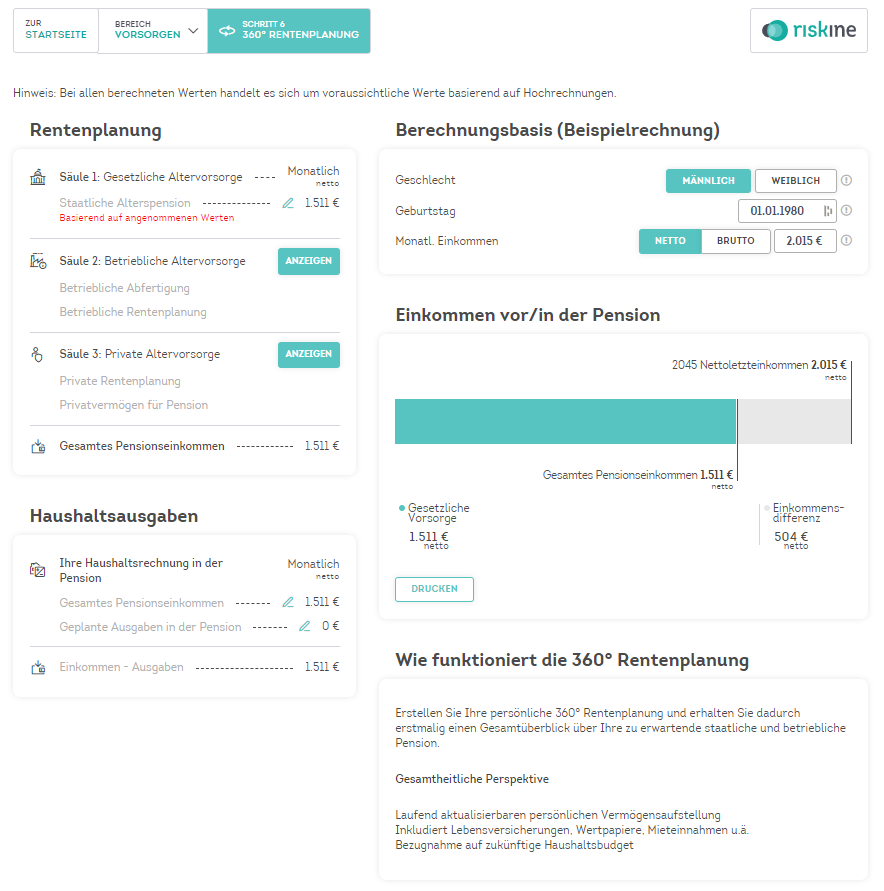

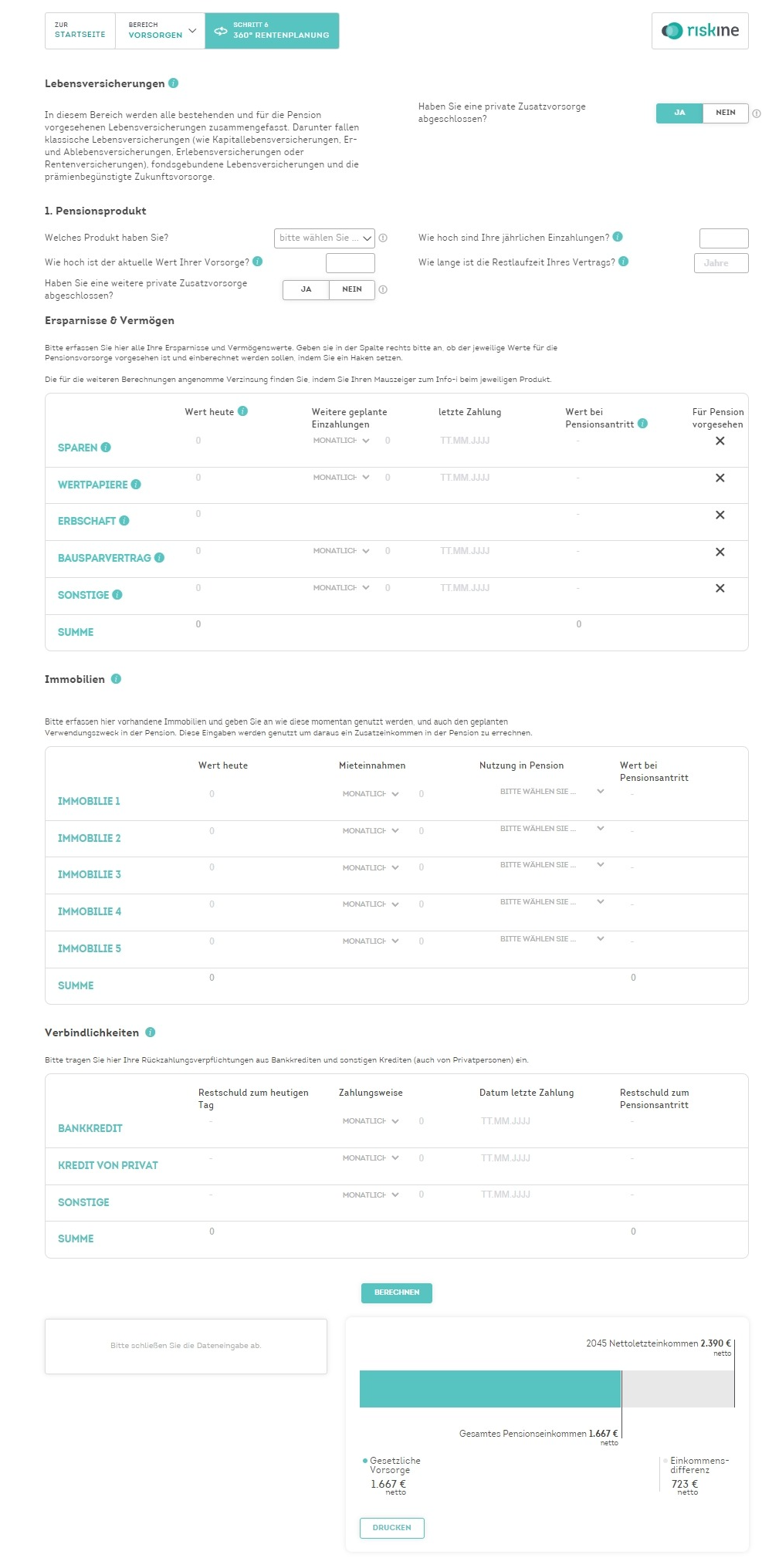

360° Retirement Planner

With our 360° Retirement Planner you can holistically calculate your customer’s expected pension gap with inclusion of all 3 pillars (statutory, occupational & private) and display them with expected monthly pension payments.

During the comprehensive analysis, our products— the State Benefits Calculator, the Wealth Overview, and the Household Budget Calculator— interact to create even more transparency for your customers’ necessary retirement decisions. Using the State Benefits Calculator, several calculations for gaps in old age, occupational incapacity, surviving dependent’s pension as well as possible claims for care pension are determined. Our Wealth Overview captures your customers’ private pension provisions and projects potential entitlements. Incorporating our Budget Calculator, current and future expenses can be compared to provide a snapshot of the household budget during retirement.

With this 360° analysis customers get a full overview and can prepare their old age provision thoroughly and choose specific products that best suit their needs.

Contract Manager

The Contract Manager enables a quick and intuitive compilation of existing insurance policies and creates an intelligent comparison with the recommended products. In the next expansion stage, your customers’ insurance gaps are visualized, and information is given as to which policies need to be checked.

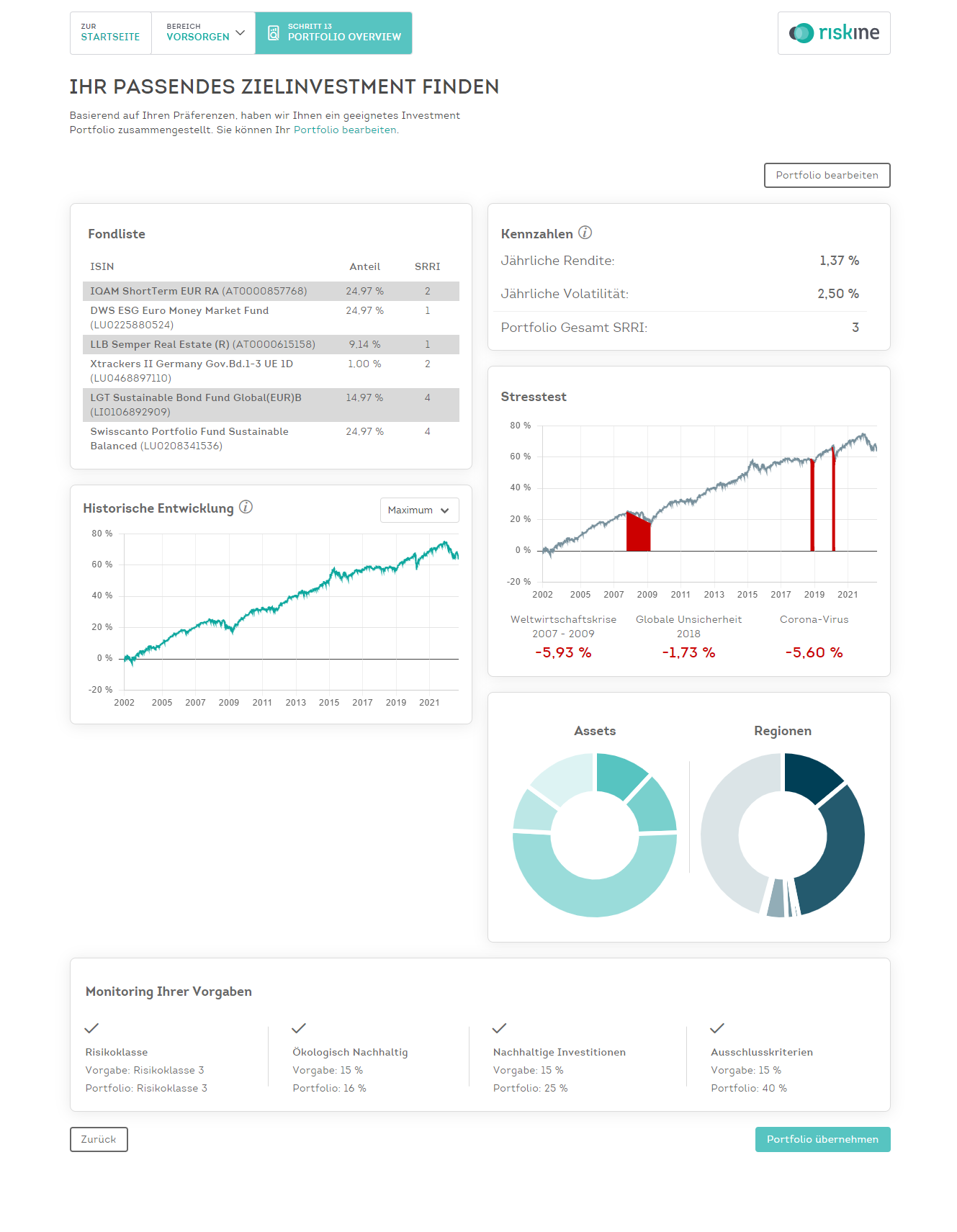

Portfolio Planner

powered by FAIT

With the help of the Portfolio Planner, you receive suitable portfolios for your customers based on your fund list that consider the selected risk class and ESG requirements. Important key figures, historical performance and the stress test support you with high-quality and transparent advisory. For example, the stress test visualizes 3 well-known stock market events and shows how the portfolio behaved in these phases. Even if declines are shown, customers can see the subsequent recovery phases immediately.

Should the portfolio follow further guidelines? No problem, you can regulate the weighting of regions or asset classes and add corresponding thematic investments.

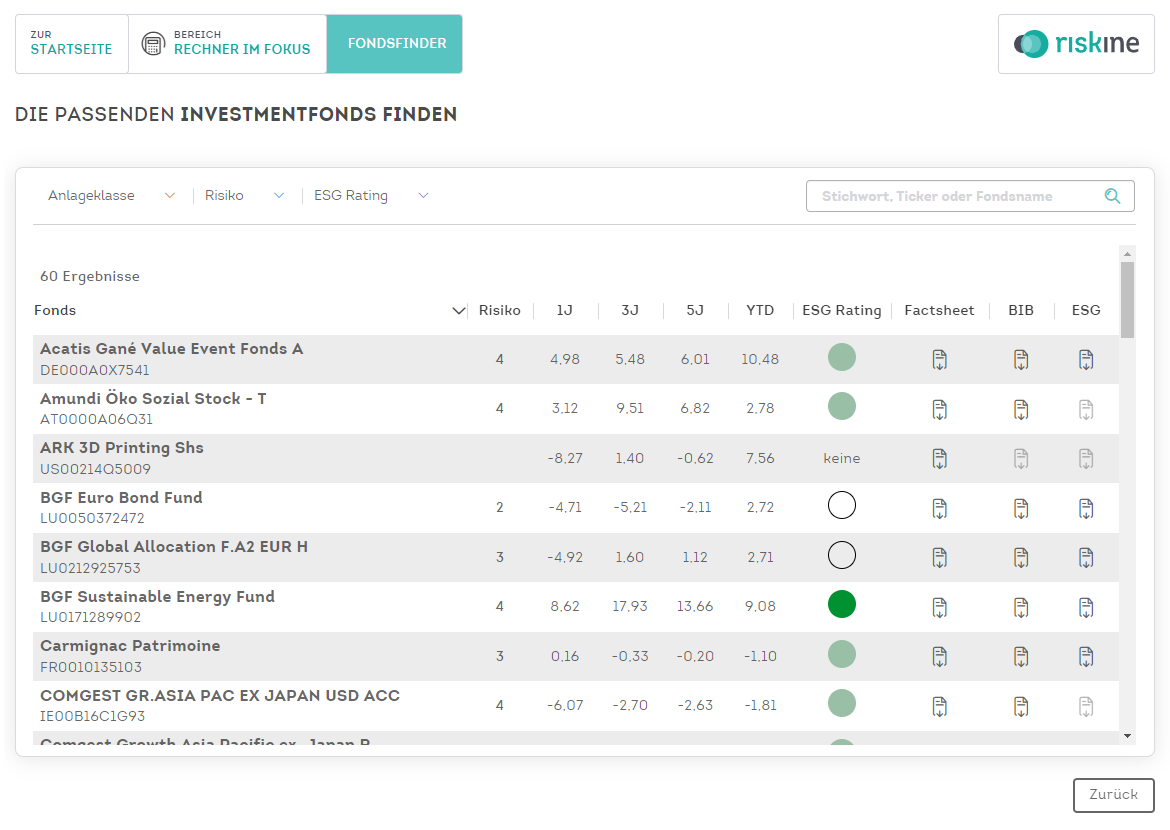

Fund Finder

The Disclosure Regulation (product categories according to Art. 6/8/9) promotes the transparency and comparability of sustainability criteria in investment products and enables investors to make better-informed decisions. Our Fund Finder supports you in fulfilling your information obligations and shows your customers all the necessary information about the investment funds on offer at a glance. The fund finder can be integrated directly on your website or in the customer portal and comes with up-to-date fund data.

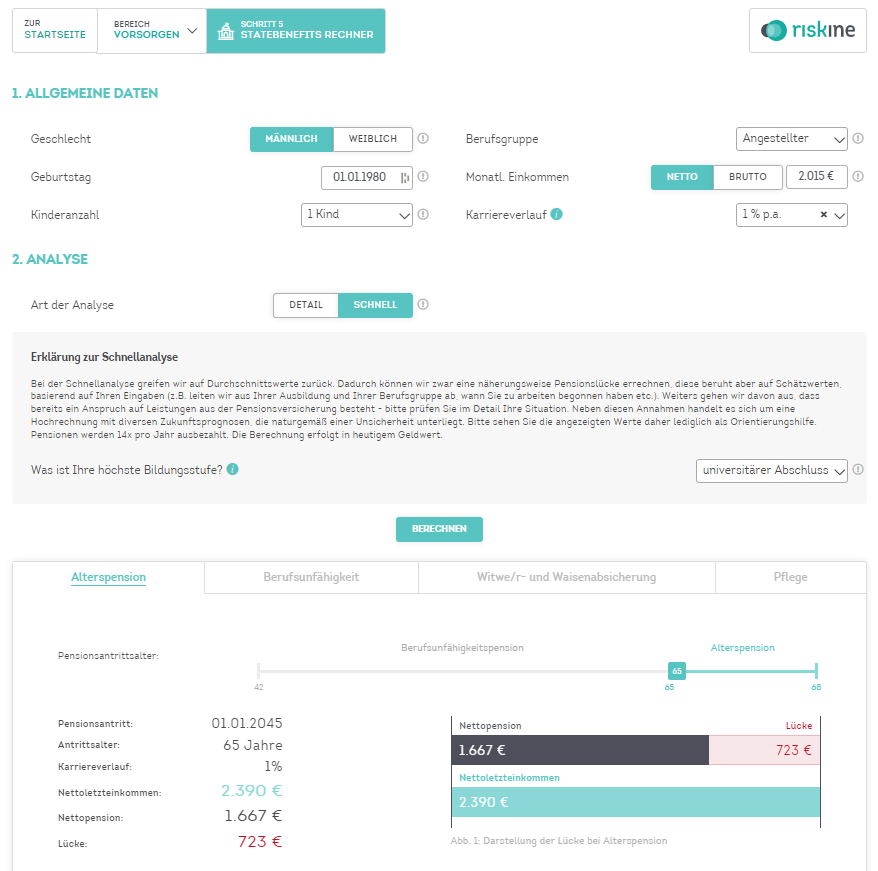

State Benefits Calculator

With our State Benefits Calculator you can show your customers an extensive overview of their different statutory pension rights. The calculator determines gaps in the areas of old age-, occupational incapacity-, surviving dependents pension as well as care claims. There is a possibility to either do a quick check with few details and estimations, or a detailed calculation with data from the customer’s pension account.

Wealth Overview

The Wealth Overview provides a list of your customers’ current assets and enables a presentation of their total assets, considering all assets and liabilities (including life insurance, real estate, financial products, mortgages, stock portfolios, etc.) as well as the predicted values upon retirement.

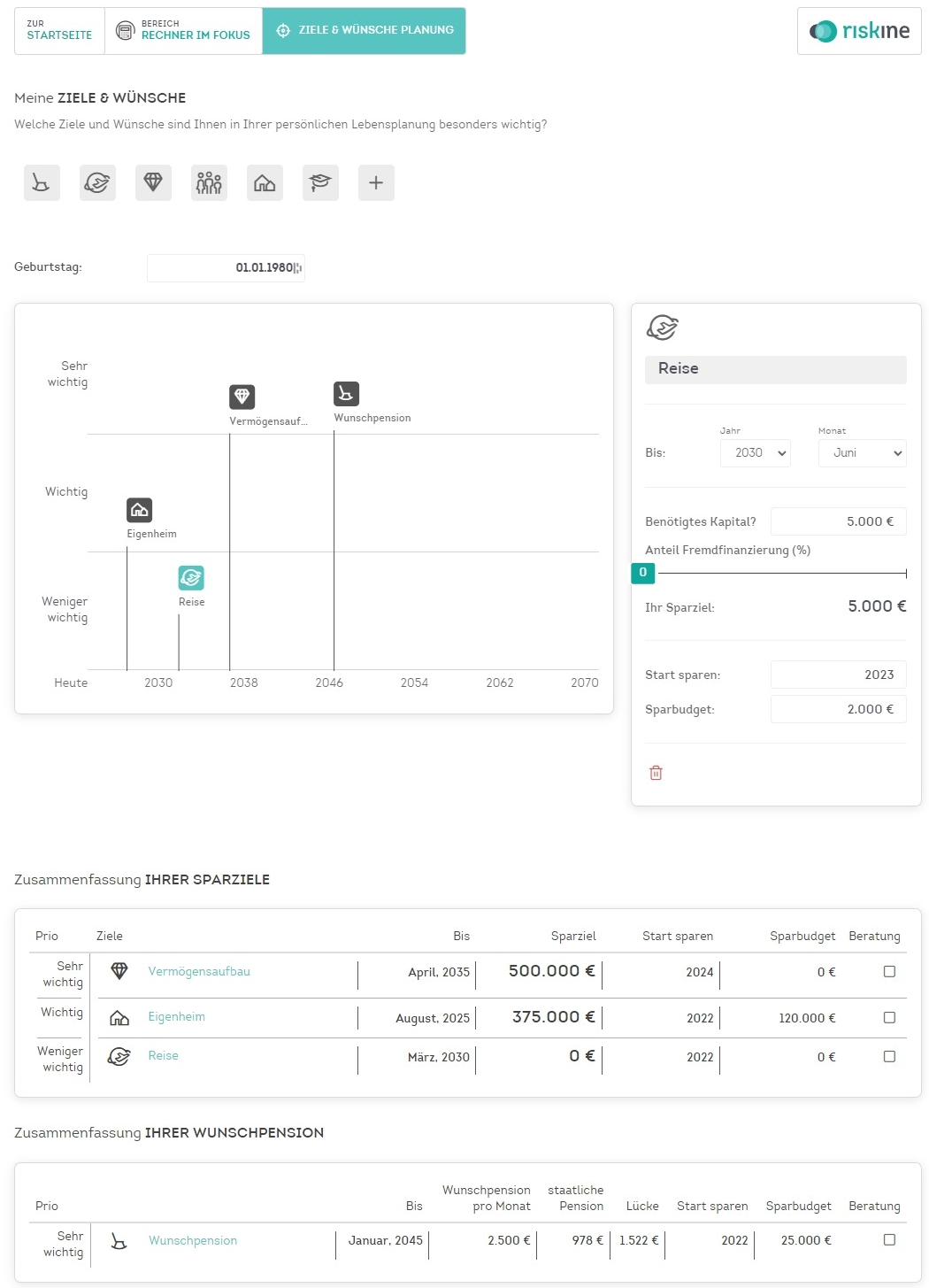

Financial Planning

What could be better than talking to your customers about their wishes, dreams and goals? Many of them require financial resources and thus good financial planning to be able to fulfill the dreams. Plan digitally now with the help of the intuitive calculator. Collect, prioritize, define and budget the goals together and prepare the next conversation on this basis.

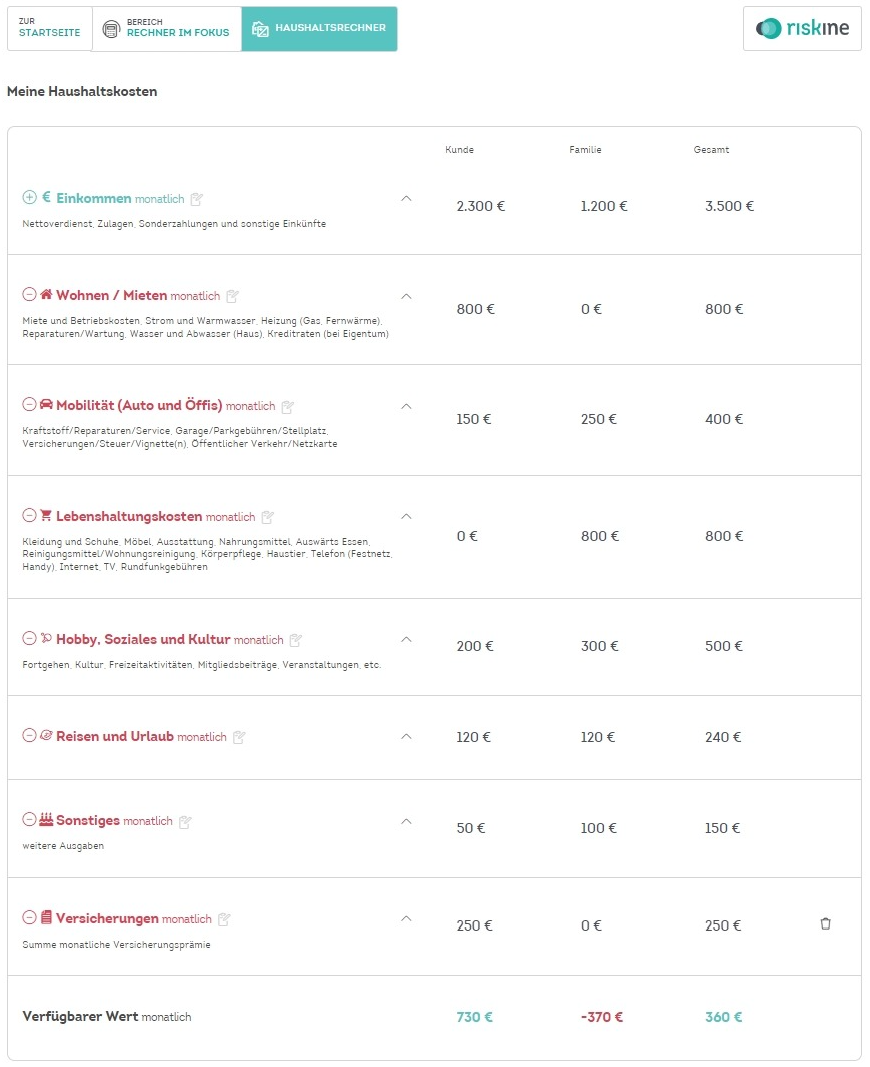

Budget Calculator

Our Budget Calculator makes finances tangible: it shows your customers at a glance how their monthly income and expenses are structured – and how much budget is available. This creates transparency, reveals saving potential, and provides the foundation for personalized and goal-oriented financial advice.

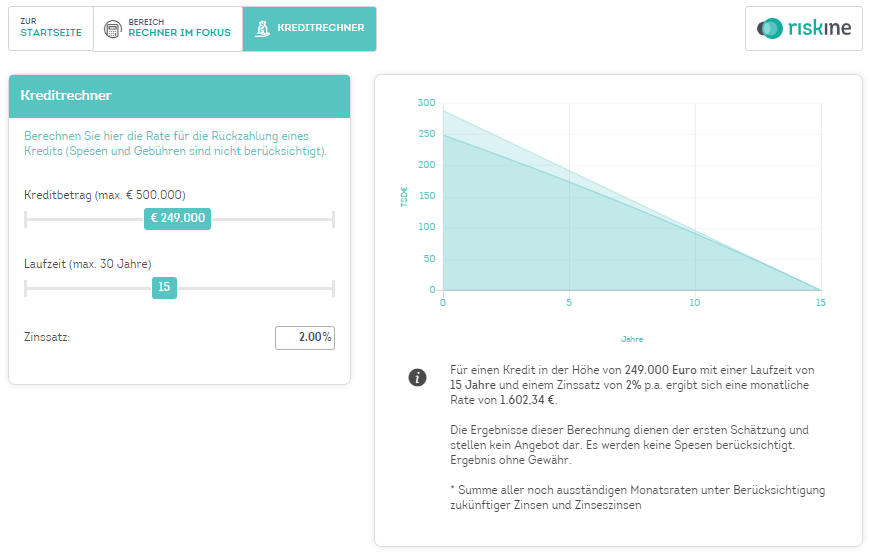

Loan Calculator

With the Loan Calculator, your customers can determine the rate for loan payments by entering the loan amount and the term.

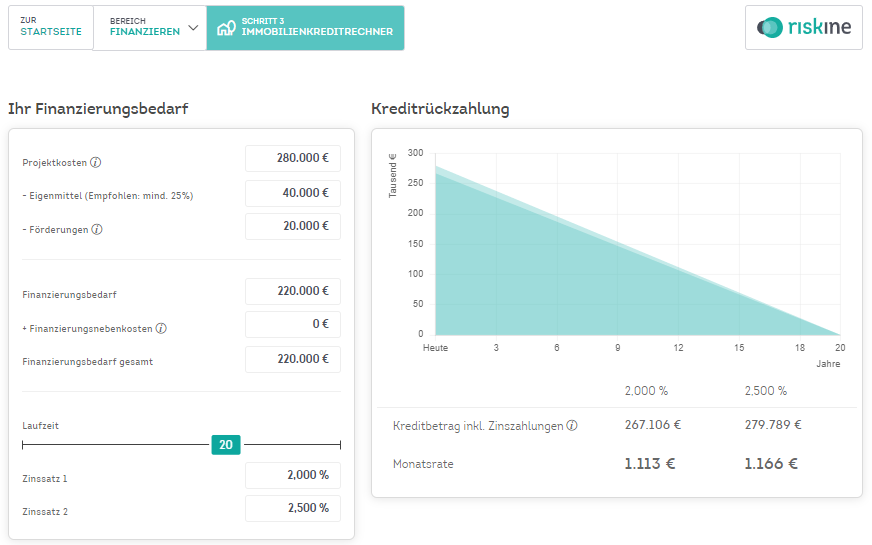

Real Estate Loan Calculator

The Real Estate Loan Calculator helps to take the first steps with your clients in financing their dream property. Based on the project costs (purchase or construction costs) and considering equity capital, subsidies and ancillary loan costs, an initial monthly loan instalment is calculated. You can flexibly adjust the term and the interest rate. This way, your customers quickly get a feeling for how they can finance their dream property. If you need a more detailed calculation, we recommend using the advanced version of our calculator. A detailed breakdown of costs or comparison of different interest rates and maturities enable an exact calculation and presentation.

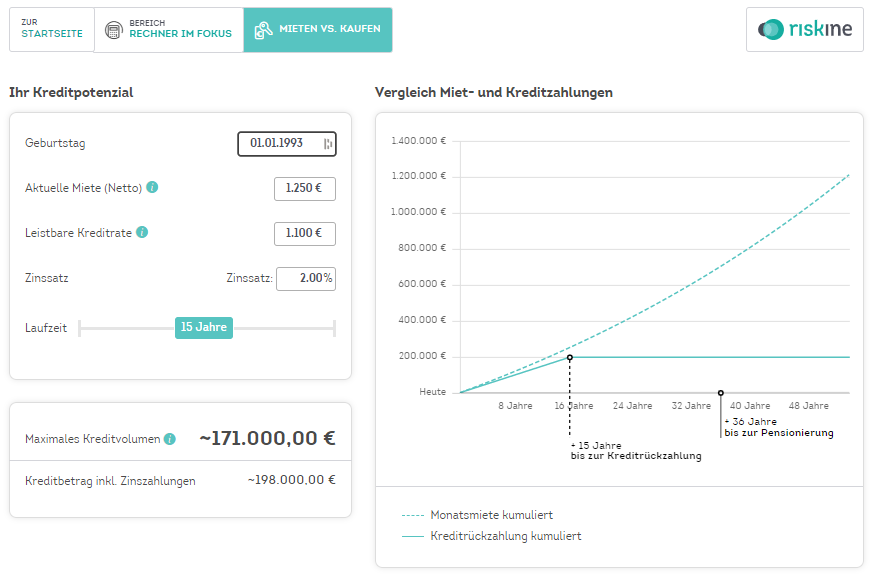

Rent vs. Buy

Whether you prefer to live in a rental property or consider buying property depends on many factors. It usually starts with the initial question of whether and how much one could afford. The "Rent or Buy Calculator" helps your customers with these considerations by providing a transparent comparison. It extrapolates the monthly rent, taking inflation into account, over the entire lifetime and at the same time calculates the possible credit potential based on the rent or an alternative amount. It then compares the rent payments and loan repayments in an overview, thus creating the basis for an ideal introduction to the topic of real estate financing.

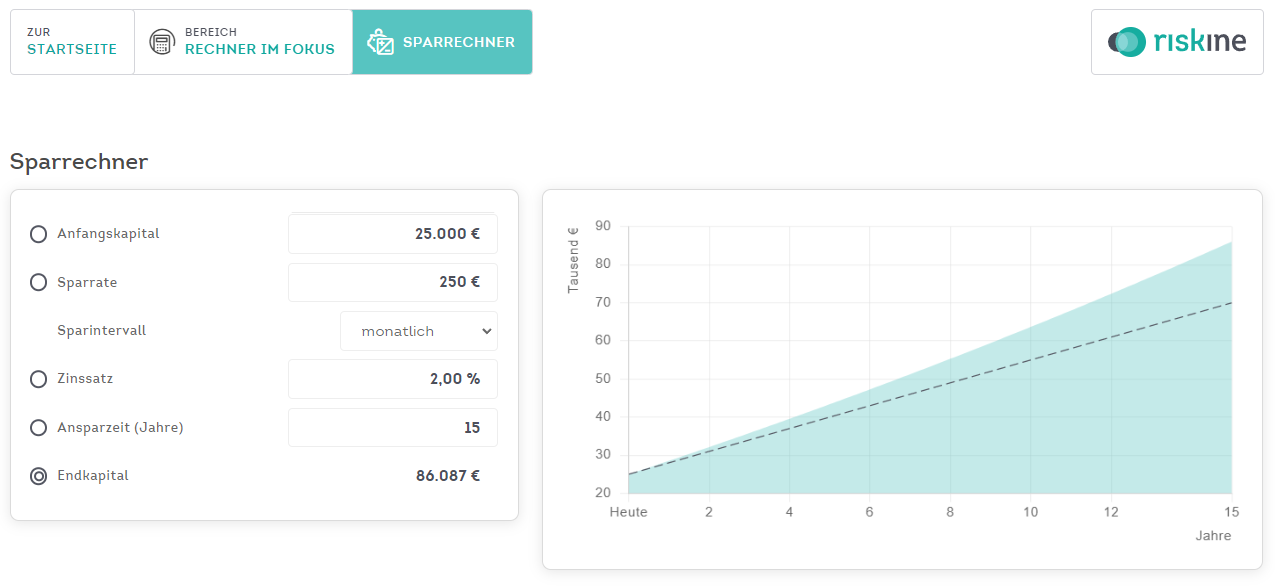

Savings Calculator

The Savings Calculator allows you to calculate the increase in value of a savings plan (with interest and compound interest) consisting of the starting capital and monthly savings amount. You can also calculate which savings rate, interest rate or time you need to reach a certain savings goal.

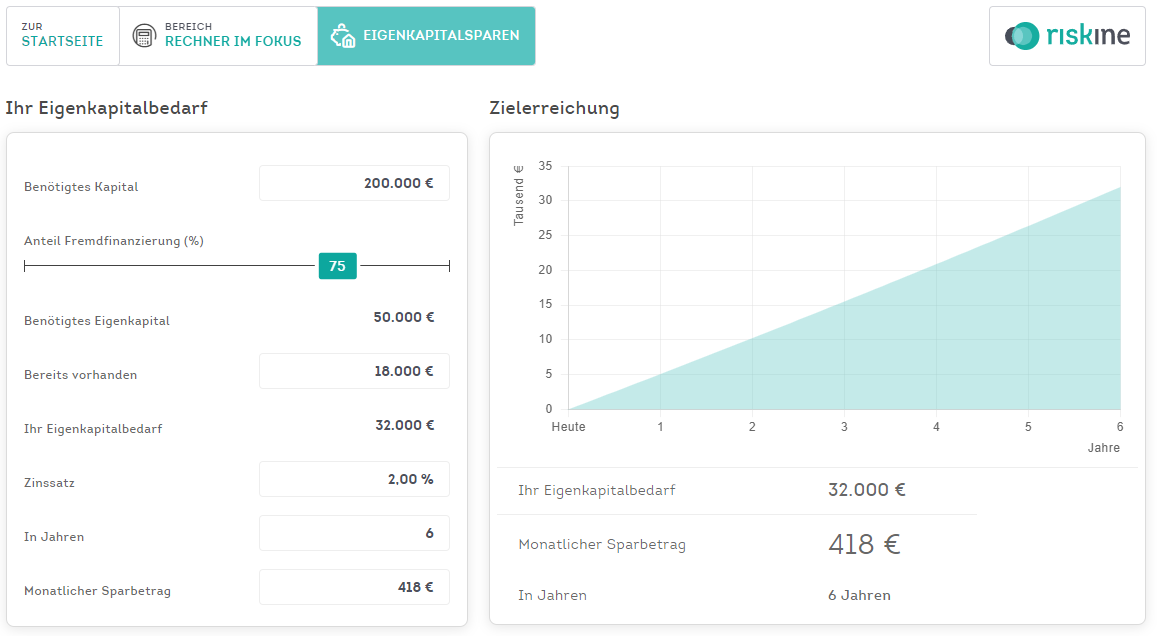

Equity Savings

Calculate how much equity is needed for your customer’s dream property and what savings rate is necessary for it.

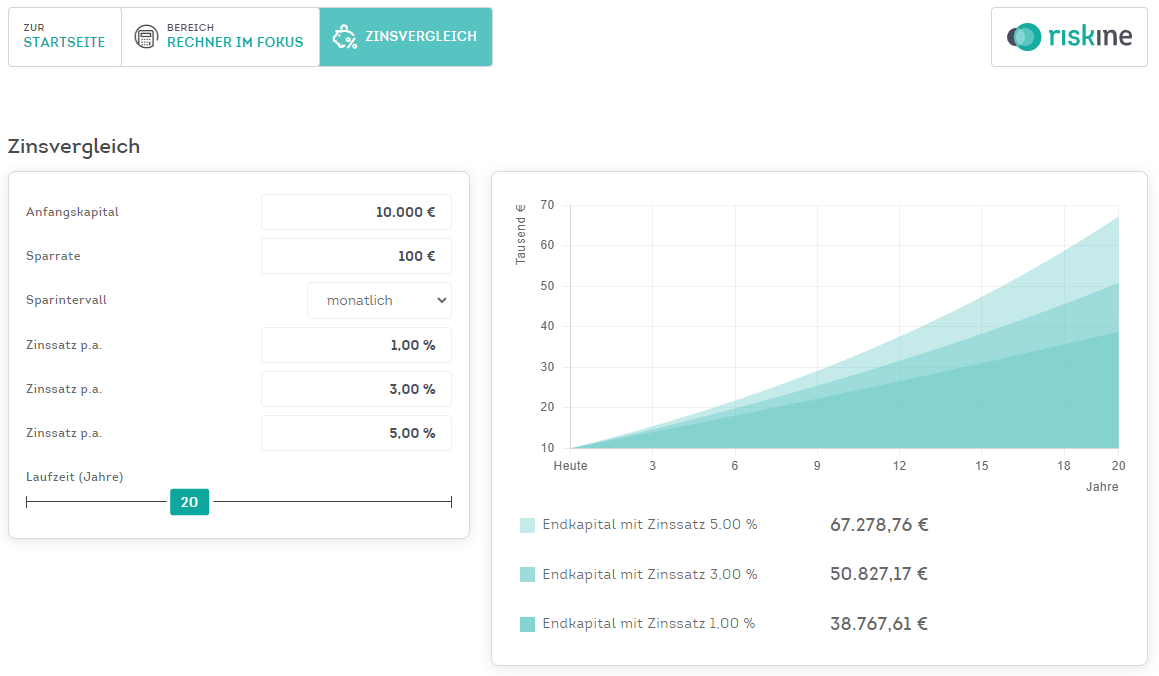

Interest rate comparison

Compare what result your customers can achieve with different interest rates.

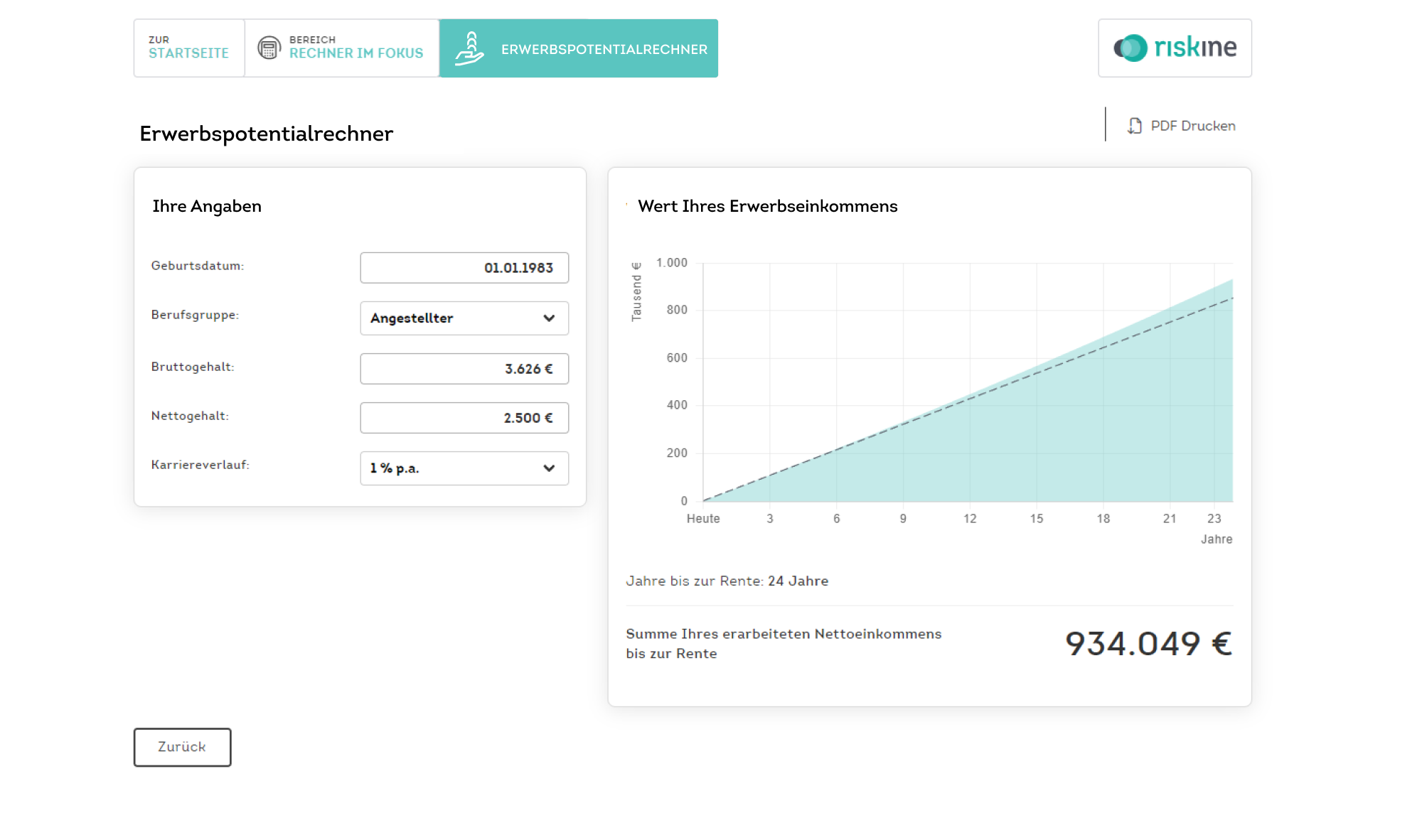

Earning Potential Calculator

On average, many people earn over a million euros during their active work life, but only a handful are aware of it. The Earning Potential Calculator visualizes the sum of income over the period of the entire active work life and takes individual career progressions into account. This allows you to show your customers the value of their own workforce as well as their individual need for coverage.

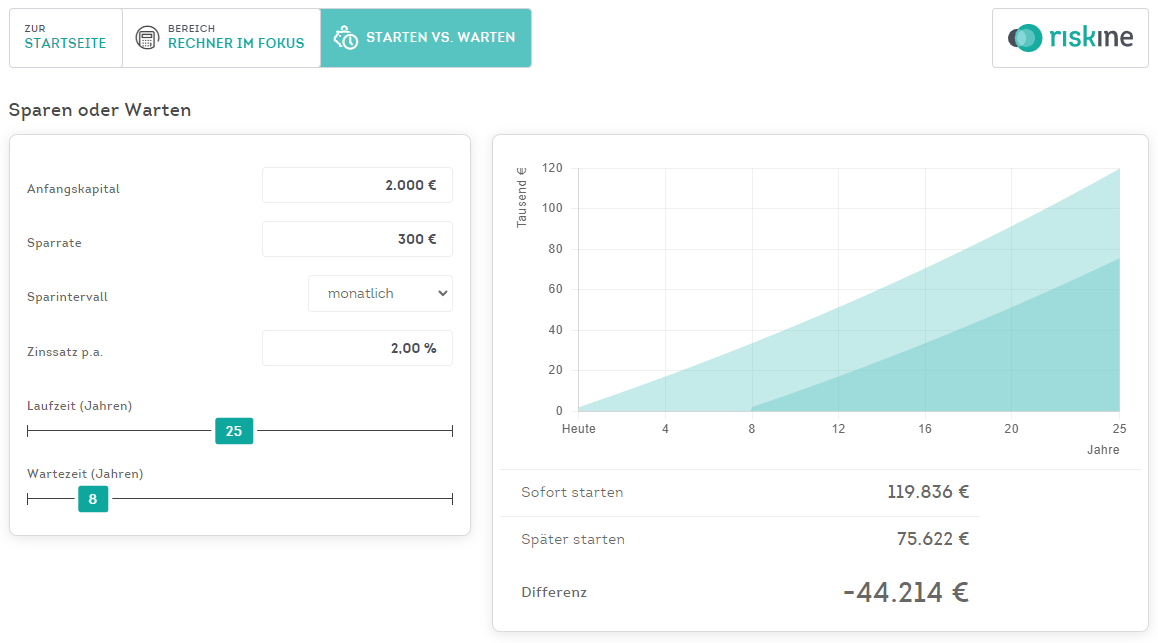

Start vs. Wait

Find out with just a few clicks what impact it will have on the overall return if your customers start saving either immediately or later.

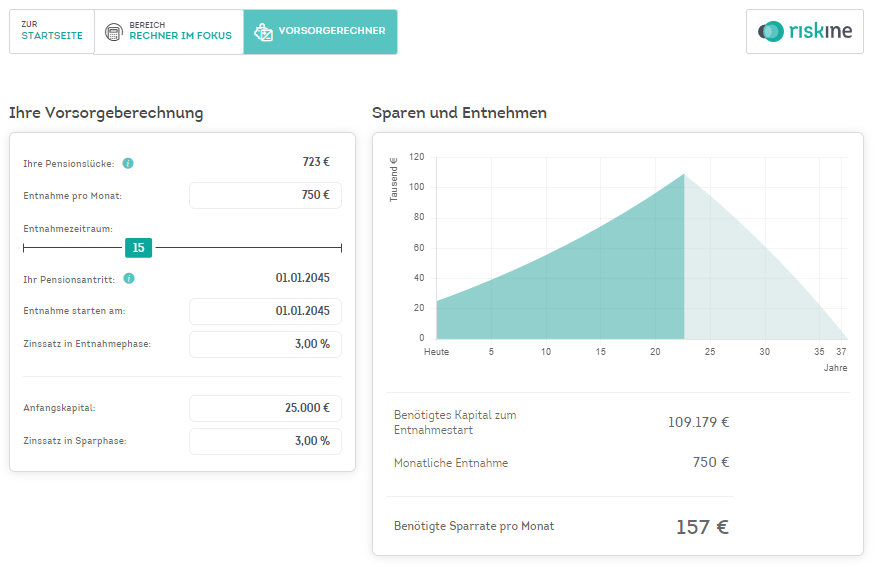

Pension Planning Calculator

Calculate the monthly savings rate with just a few parameters to support your customers in closing their pension gap.

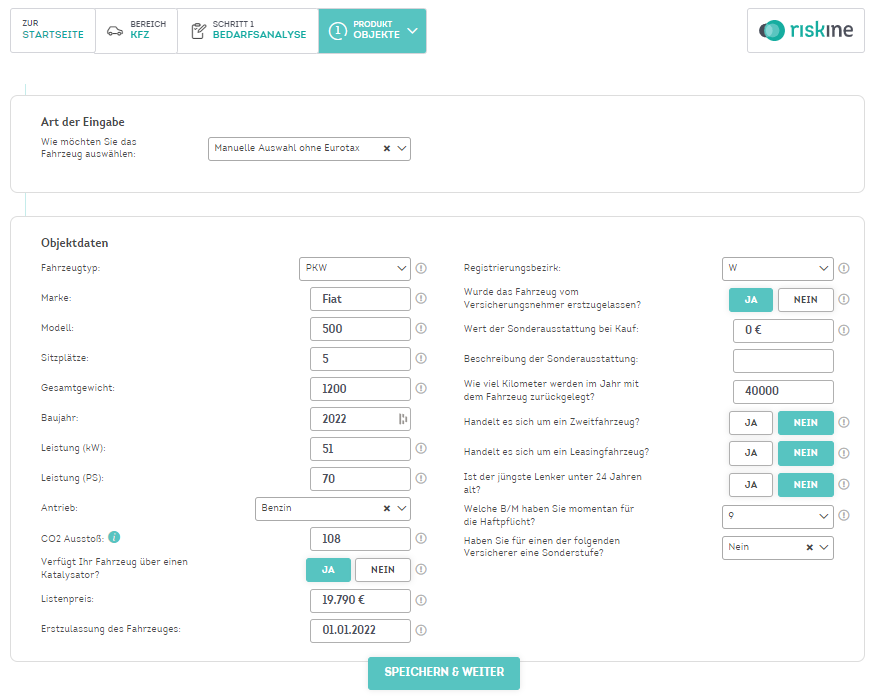

Car insurance comparison

The Car Insurance Comparison enables a complete API-based advisory process for brokers. From the premium and performance comparison to the offer and proposal.

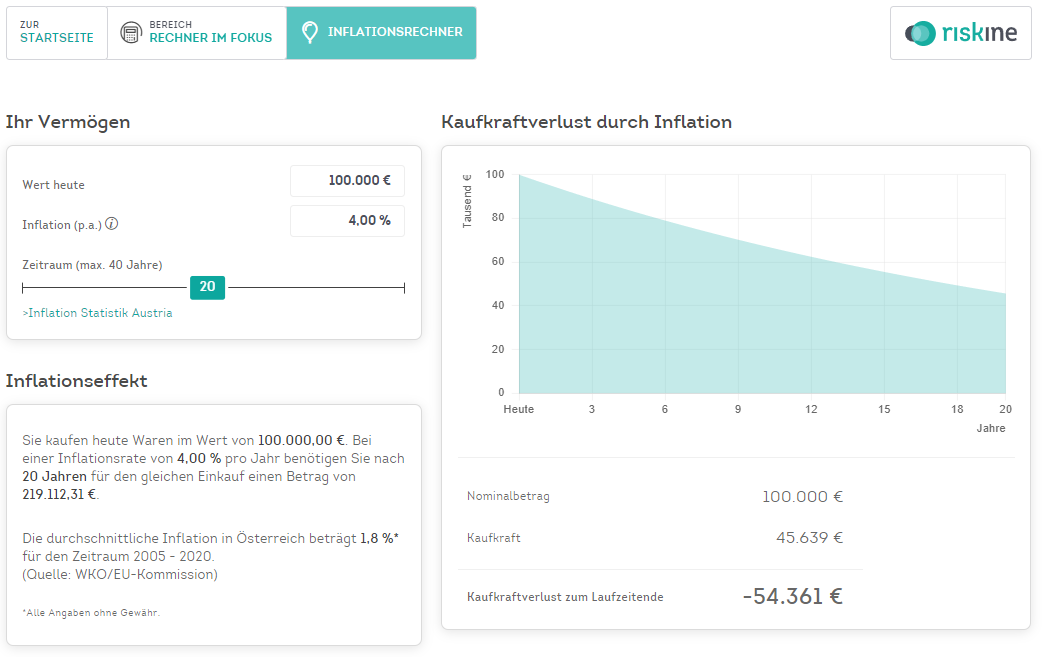

Inflation Calculator

Many people feel the effects of inflation in their daily lives. However, not everyone is aware of what this means over a longer period and what financial impact this has on pension provision. With the Inflation Calculator you can easily explain the inflation-related loss of purchasing power over a freely selectable period. Based on many details and clear explanations, you thereby create a basis for the transition to appropriate pension products.

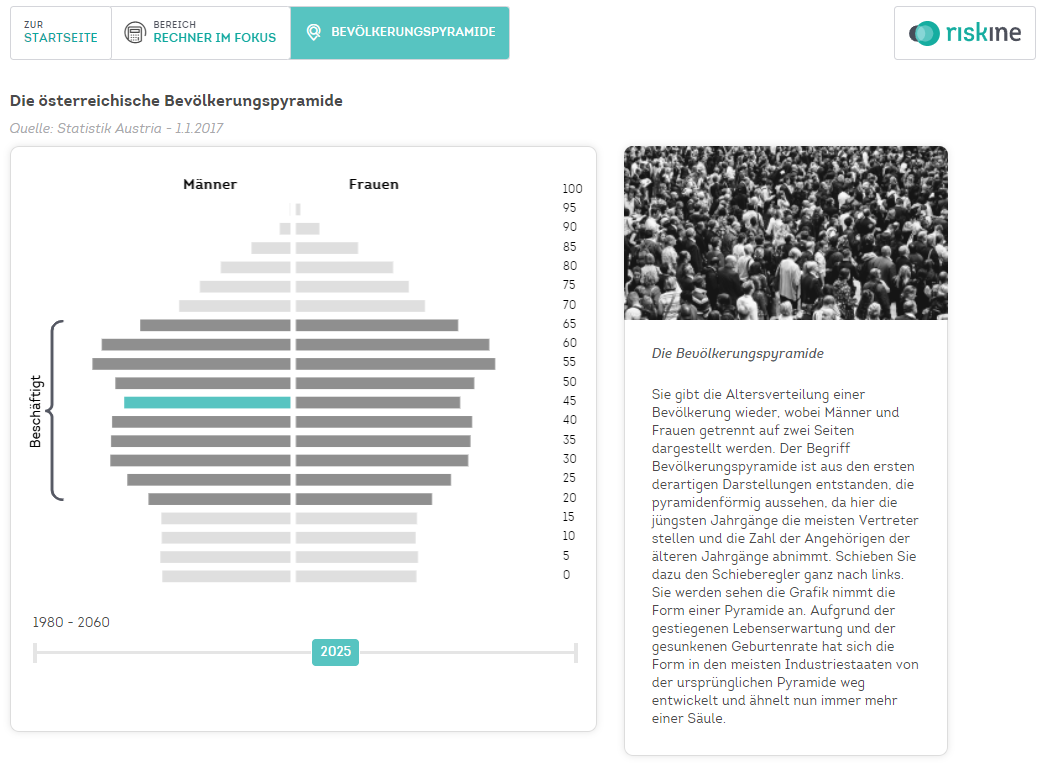

Population Pyramid

The Population Pyramid visualizes the development of the relationship between the working population and pensioners over time and thus creates a deeper understanding of the need for private provision.

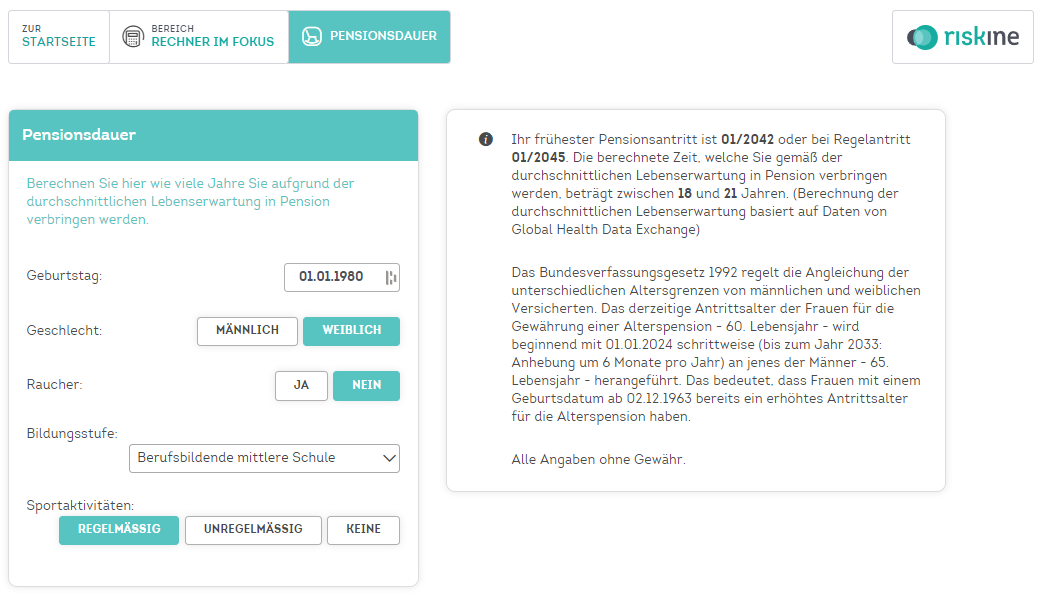

Pension Duration

Based on statistical data, this calculator provides information about the probable retirement period of your customers.

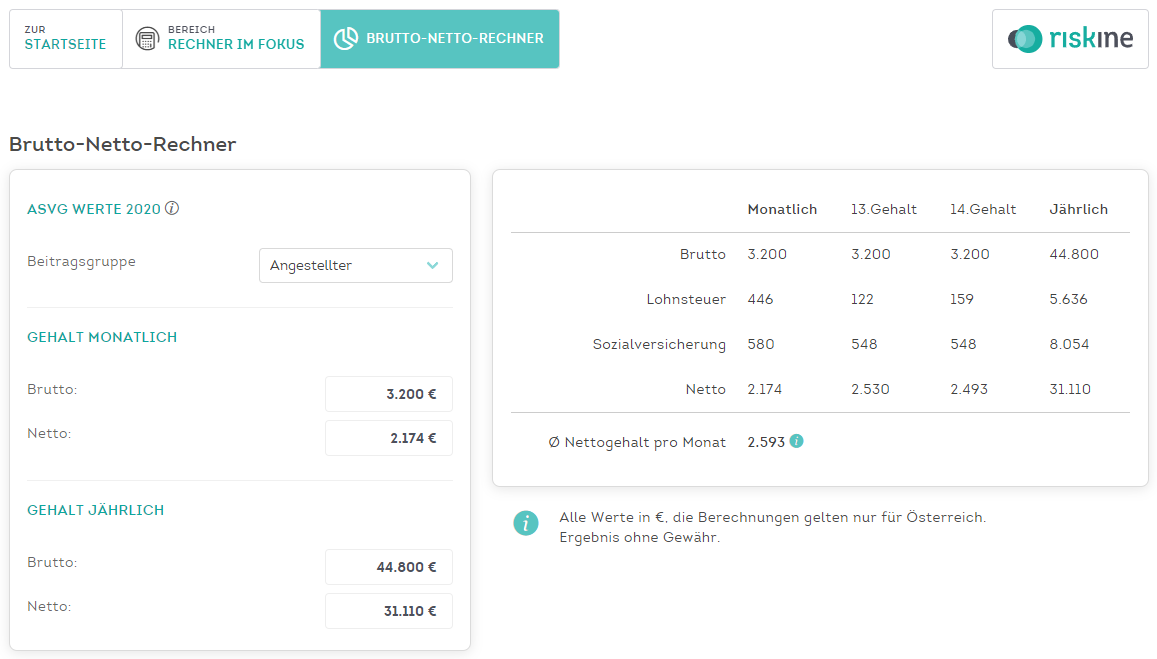

Gross-Net-Calculator

Our Gross-Net-Calculator is integrated into all our advisory solutions. It provides an overview of how much income is left after deducting income tax and social security, while taking into consideration the differences within the respective occupational groups. By entering data into one field, it automatically calculates the other.

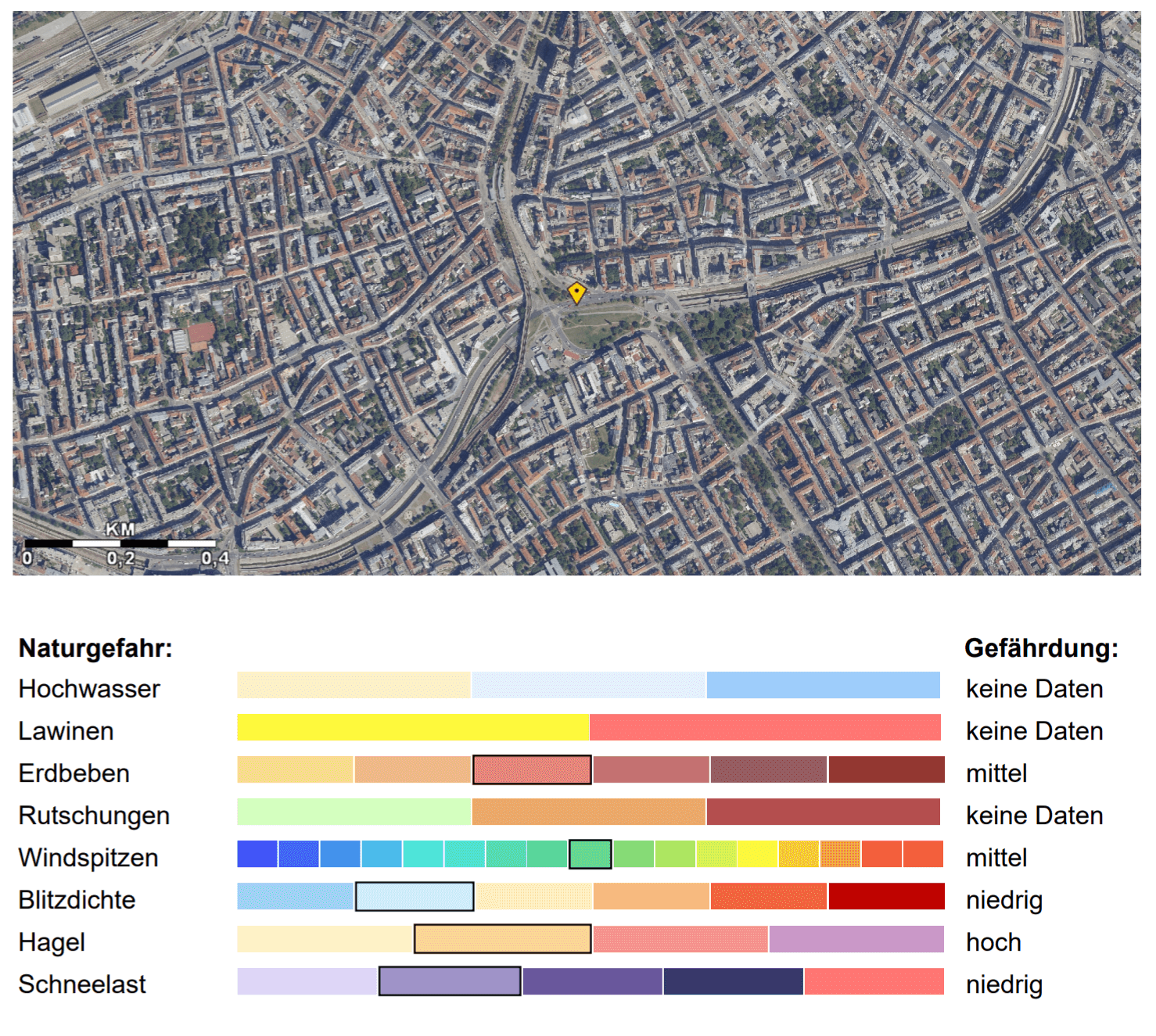

Nat-Kat-Check

This product helps you to see which natural catastrophe risks are highest for your customers using GPS coordinates of their home addresses. With our Nat-Kat-Check you can sensitize your customers for potential risks or use it for active lead generation.

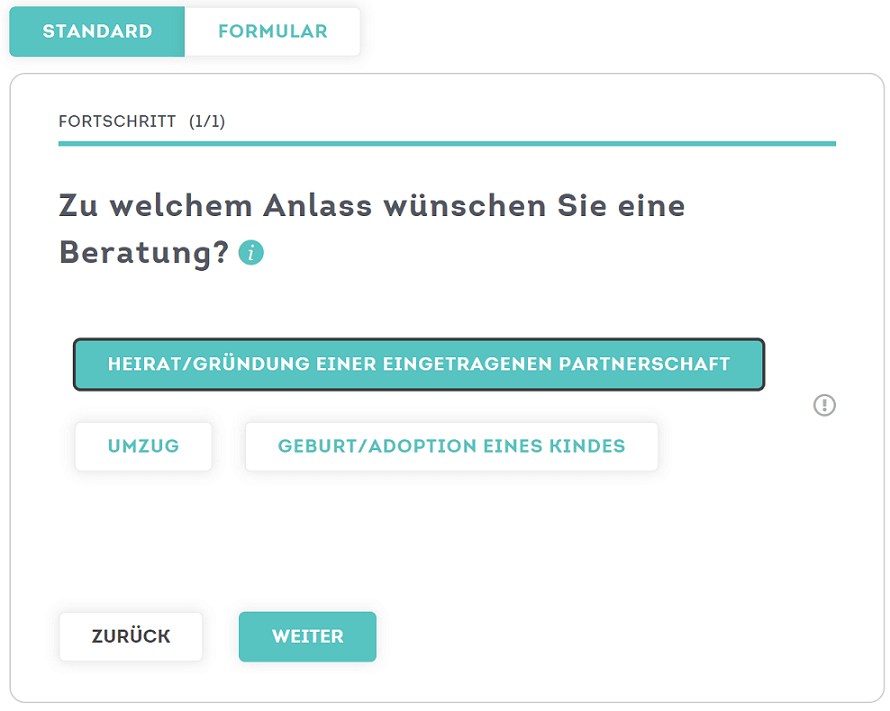

Event Driven Advisory

Our Event Driven Advisory enables you to advise your customers purposefully and fully upon changes in their current living situations. During the advisory session, checklists that provide a holistic overview are used to determine customers’ needs. First, important, and relevant life events are covered, e.g. moving to a new home, getting married/entering civil life partnership or the birth of a child. With our Event Driven Advisory, you can advise and provide information for your customers fitting their new life circumstances, therefore selling more relevant products.

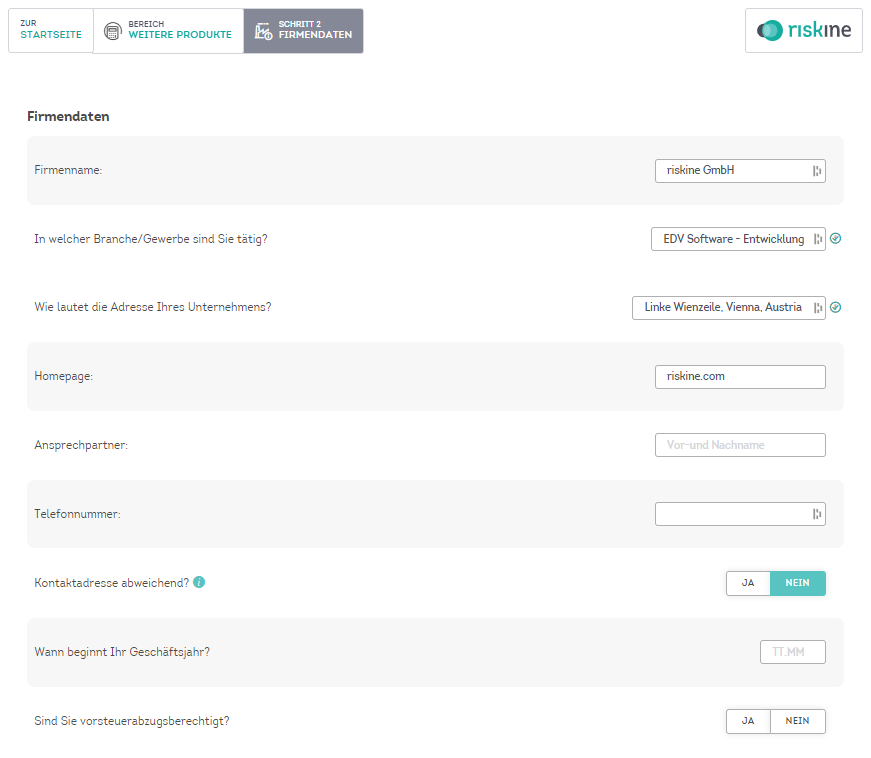

Company Data

In the Business Customer Advisory, it is essential to store your customer’s company data. Additionally, your advisor’s administrative workload should be reduced so they can fully focus on their customers. By integrating our Company Data tool, all your customer’s previously entered company data will be automatically filled into the advisory session.